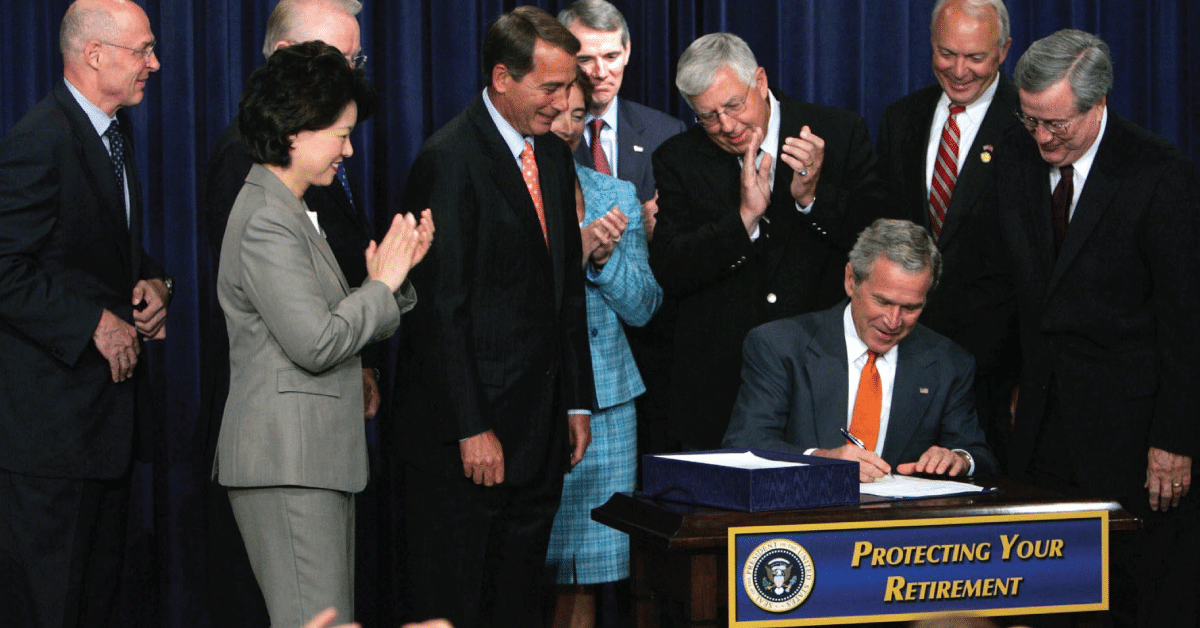

The Pension Protection Act Decreased Retirement Security

In August, we wrote about the decline of traditional pensions in the private sector. One of the major reasons for private companies abandoning pensions was a series of laws beginning in the 1980s and culminating in the Pension Protection Act…