Resources

Pension Term Glossary

Actuary – a business professional who deals with the measurement and management of risk and uncertainty in fields like insurance. When it comes to public pensions, actuaries determine how much employers and employees need to contribute in a given year so that promised pension benefits will be available when the employee retires.

Annuity – a specified income payable at regular, stated intervals for a set time period, often for the remainder of a recipient’s life.

Annual Required Contribution – the actuarially determined pension fund contribution in a single year. This includes the normal cost of the plan (the cost of pension benefits earned in the current year) and also may include another payment that may be required to pay for a portion of benefits earned in past years that have not yet been funded. Paying the full ARC each year is the single most important thing an employer, such as state or local government, can do to maintain a well-funded public pension.

Defined Benefit Plan – employee group retirement plan established and maintained by an employer that uses a predetermined formula to calculate the amount of an employee’s retirement benefit. The benefit formula may take into consideration an employee’s years of service and salary during employment. No individual accounts are maintained.

Defined Contribution Plan – a plan that provides an individual retirement account for each participant with benefits based solely on (1) the amount contributed to the participant’s account plus (2) any income, expenses, gains, losses, and forfeitures from other participants. Contributions to the account may be made by the employee or the employer. Defined contribution plans include 401(k), 403(b), and 457 plans.

Pension – steady income given to a person as the result of service that begins when a specific event occurs (such as retirement). Pensions are typically paid monthly and based on factors such as years of service and prior compensation. The payment may be made by a government, employer, pension fund, or life insurance company.

Unfunded Actuarially Accrued Liability – amount that a pension system owes its members that exceeds the value of assets in the fund. In other words, if a pension system owes its members $20 million in pension benefits, but it only has $18 million in assets, then the $2 million difference is the unfunded actuarially accrued liability. It’s important to note that the UAAL is never due all at once, but can be paid off over time.

Vesting Period – process by which a participant obtains nonforfeitable rights to benefits, such as an employee retirement plan. Typically, these rights accrue based on an employee’s years of service to an employer. For example, an employee may be required to work for an employer for five years before becoming fully vested in their pension.

From the blog

-

This Week in Pensions: March 6, 2026

This Week in Pensions: March 6, 2026

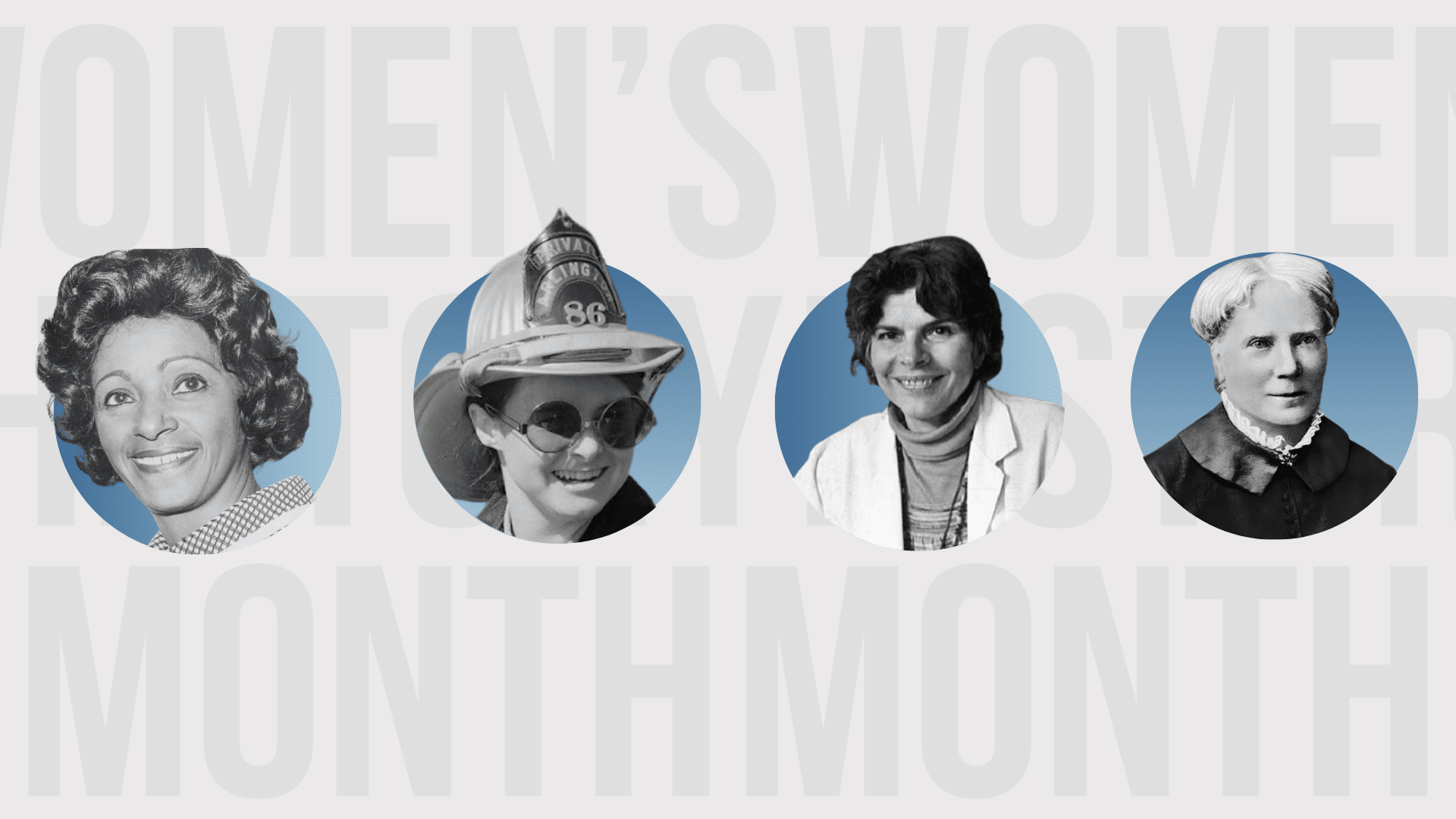

NPPC Highlight Celebrating Women Who Shaped Public Service In honor of Women’s History Month, we highlighted four women who broke barriers in the public sector and helped shape stronger communities for future generations. From education and public health to civil…

-

Women Who Paved the Way in Public Service

Women Who Paved the Way in Public Service

In honor of Women’s History Month, we at NPPC want to spotlight several remarkable women who made significant contributions to the public sector, broke barriers, and inspired future generations. These four trailblazers dedicated their lives to serving others—educating students, improving…

-

This Week in Pensions: February 27, 2026

This Week in Pensions: February 27, 2026

Washington State Moves to “Strip Away” $3.3 Billion From Police & Fire Pension Opposition is mounting to Washington legislation that pension advocates warn could weaken first responders’ pensions through the Law Enforcement Officers’ and Fire Fighters’ (LEOFF) Plan. A coalition…